Today’s column will contain some of the most valuable investing advice you’ll ever read. But be warned.

You won’t see this anywhere else.

What I have to say is direct… blunt, even.

I’ve chosen to publish this column today because I want every investor who reads it to have a fighting chance in the months ahead, at a time when the headlines are hopelessly negative and running for the hills seems like a prudent thing to do.

The coronavirus situation is a long way from over and a huge number of unknowns remain – any one of which could prompt more selling ahead.

Not 1 in 1 million investors will come to terms with today’s message, which is too bad, considering how much wealth will be created by those few – like you – who do.

The Right Perspective Can Turn Pessimism into Profits

Years ago, I was a typical newbie investor trying to make sense of the financial markets. Like many people in the early 1980s, I found it difficult to come to terms with the collapse of the Soviet Union, runaway inflation that was a legacy of the 1970s, a recession, oil deregulation, and more, when it came to my money.

The headlines were extremely negative, leading some very smart people to conclude that the economic woes of the time were insurmountable – and that investing was not worth the risk.

My grandmother Virginia “Mimi” Gruner didn’t see things that way.

A self-taught investor widowed at a young age, she was making thousands of dollars a month at a time when that was inconceivable, and her portfolio was doing exceptionally well.

I asked Mimi how she was doing that. What was she buying?

She told me… and my understanding of how markets worked changed overnight.

What did Mimi say?

Was it about which companies to buy? Cutting risk? Finding undiscovered stocks?

No.

Psychology.

Mimi simply looked across the dining room table and said:

“People want to believe the world is going to hell in a handbasket.”

That was a major “a-ha” moment for me.

Suddenly I understood why most investors do what they do…

- Why they cannot buy low and sell high.

- Why they try to time the markets, even though that almost never works.

- And why they cannot remove emotion from the equation, even though they know it’s the single biggest thing standing between them and the profits they crave.

More importantly, I also understood how to find the biggest, most profitable opportunities when others saw only chaos.

Shortly after Mimi and I had that conversation, I stumbled onto research from Carnegie Mellon’s Michael F. Scheier and the University of Miami’s Chuck S. Carver. As it turns out, Scheier and Carver were the first to put together the scientific linkage between optimism and expectation in a groundbreaking 1985 study.

They found that optimists are “problem solvers who try to improve the situation.” Pessimists simply let their behavior get the better of them.

Which brings me back to Mimi’s point about why negative headlines make the news.

[CRITICAL] Why You Should Be Trading THIS During a Global Pandemic

Simply put, it’s easier to believe pessimists.

Optimists sound like they’re throwing caution to the wind. The term carries an almost reckless connotation, especially today when the risks we face seem higher than they’ve ever been before.

When it comes to your money, a bearish view just sounds… well… smarter.

The unspoken message is that pessimists have somehow dug deeper or gone beyond the obvious to develop a nuanced view to explain what’s around the next corner.

You can’t blame people for feeling this way, given the downright apocalyptic headlines at the moment:

- Gov. Cuomo says coronavirus is ‘more dangerous’ than expected as New York cases jump 14% overnight to 75,795 – CNBC

- Economists are Losing Hope in a ‘V-Shaped” Post Virus Recovery – Bloomberg

- US GDP to Plummet 34% in second quarter: Goldman Sachs – Fox Business Network

- Models Forecasting Grim Coronavirus Toll in US to be Released – NYTimes

Yet, Mimi would tell you pessimism only sounds intelligent because investors subconsciously interpret it as a protective reflex and – here’s the important part – even when the data shows beyond any shadow of a doubt that staying the course is the far more profitable course of action.

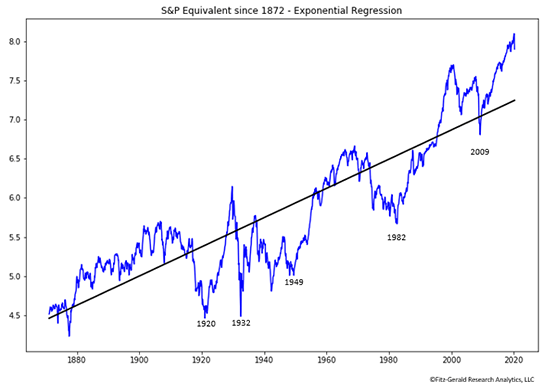

“Bond King” Bill Gross famously predicted the Dow Jones Industrial Average would sink to 5,000 in 2009. It rose a staggering 61.11% from 2009 lows to a high of 10,548 by December of the same year..

In 2010, Elliott wave expert Robert Prechter called the Dow at 1,000 – and a looming market crash of staggering proportions.

Demographic researcher Harry Dent took the internet by storm in 2011, claiming the Dow would fall to 3,000. After a mere 13% dip that year, it’s headed higher.

In 2010, Euro Pacific Capital President Peter Schiff predicted that the Dow would collapse to 2,000. It’s up 105.2% as I type even after being ravaged by coronavirus fears.

In March 2014, Dent piled on again, saying that the Dow was setting itself up for a major crash that would give investors a 50% haircut and take the average to 6,000 by 2016. Today the average trades around 21,427 as I type.

Unfortunately, as bright as these individuals are, what they’re doing is a lot like predicting ten out of the last two recessions, and about as useful as worrying there will be 18 feet of snow in July based on three inches in November.

Eventually, though, they’ll get it right at which point they’ll claim vindication.

I’d rather see you claim profits.

Case in point, my team and I have helped readers identify literally hundreds of double- and triple-digit winners, including 326%, 174%, and 214%, with Altria Group Inc. (NYSE:MO), American Water Works Company Inc. (NYSE:AWK), and Raytheon Co. (NYSE:RTN), respectively. Meanwhile, the folks I just mentioned along with legions of others were warning of financial Armageddon in the interim

How?

[ACT NOW] What to Do to Protect Your Wealth for Generations During the Coronavirus Scare

By keeping the following Five Total Wealth Principles in mind no matter how scary the headlines get and even if there is more selling ahead:

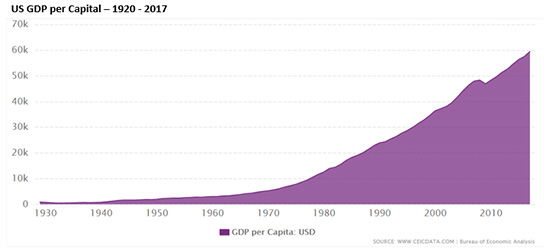

- Capital is a creative force and the foundation of wealth, which, in turn, is the embodiment of ideas. It is constantly growing and has been since the dawn of time. Sometimes growth slows, as is the case at present, but it will not stop.

- The markets have an upward bias, which is a function of constantly increasing amounts of money chasing fewer quality stocks over time. You can argue that the markets go up and down, and you’d be right. But that does not change the fact that the general direction over time is up. The only question is how you handle the swings, and that comes down to proper risk management.

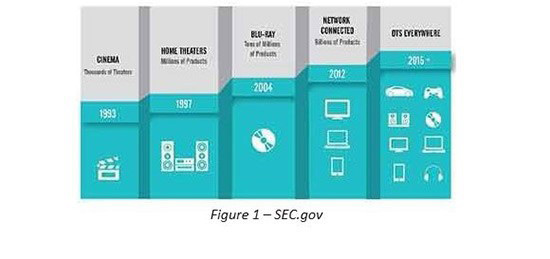

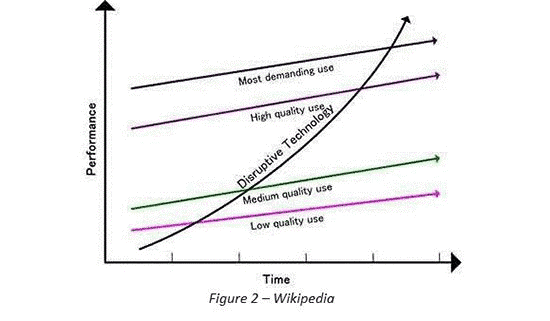

- Technology increases total market size every time in every industry. Many pessimists base their argument on extrapolation. It’s logical, for example, to assume the markets would go to zero if you looked at what happened in 2009 when the bottom fell out and millions of investors believed the end of the financial universe was upon us. But, like the example I just talked about, that’s a lot like saying we’ll have 18 feet of snow on the ground in July based on 3 inches falling in November – and about as accurate. If you’re going to extrapolate anything, understand that technology is the one constant capable of increasing market size everywhere it occurs. This means a constantly expanding stream of ideas that are ultimately translated into earnings and, in turn, higher stock prices over time.

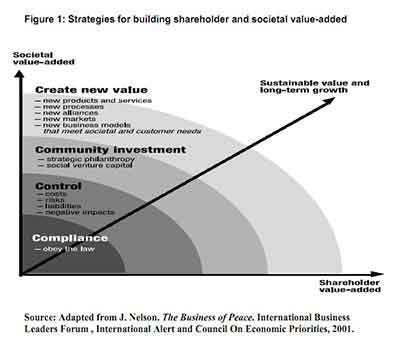

- Profits follow innovation. Pessimists take doom and gloom personally and view it as a form of ultimatum. Optimists, on the other hand, view doom and gloom like I do and Mimi did – as an opportunity to try something different. Anything negative is only temporary, which is why you should keep in mind innovation has never failed to produce profits. Ever.

- Disruption crosses every economic strata. Pessimists want everybody to fail, whereas optimists want even pessimists to succeed. That’s why disruption and disruptive technology are so powerful and so capable of overcoming even the worst pessimism.

In closing, I realize that we’ve covered a lot of ground here. I know it will take a while to sink in, especially if you’re prone to pessimism – as many investors are at the moment with the coronavirus situation raging.

Mimi and I had our conversation nearly 40 years ago, and I still struggle from time to time to separate how I feel about a particularly nasty headline from what I know about money and profits. Not every prediction I’ve made has been on the mark, either, but I’ve never let that get in the way of profit potential.

You shouldn’t either.

Until next time,

Keith

The post Don’t Believe Everything You Read No Matter How Bad Things Look appeared first on Total Wealth.

Powered by WPeMatico