Recent selling has been as brutal as it has been sustained. Many investors are scrambling to figure out how much “more” they can take.

Good!

Panic is a perfect contrarian indicator.

History shows very clearly that this selloff will eventually prove to be a monumental buying opportunity – perhaps even, dare I say it, a generational play the likes of which you see once or perhaps twice in your investing lifetime.

Savvy investors who start thinking about that possibility now will have a huge advantage when the time comes.

Especially if you use the right tactics.

Here are three smart moves to get you started.

The first thing you’ll want to focus on is when to make your move.

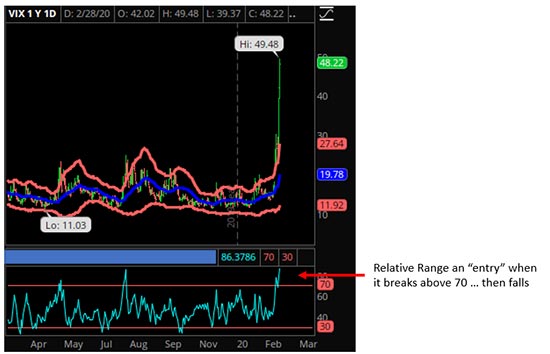

I suggest watching the VIX for a sustained fall using an indicator like “Relative Range” which you can see here in the following chart. The values are less important than the break above statistical norms and the high of 49.48.

Figure 1 Fitz-Gerald Research Analytics, LLCAs you can clearly see, volatility has broken well above anything even remotely resembling rational behavior under normal statistical conditions.

“Why” doesn’t actually matter, so don’t spend a lot of mental energy that could otherwise be put to productive use. That is has is what you want to focus on.

The VIX Index, in case you’re not familiar with it, is a calculation measuring the expected volatility of the US stock market based on real-time, mid-quote prices of S&P 500 Index (SPX) options.

High VIX readings imply a greater expected move in the S&P 500, while lower VIX readings imply a smaller move. Generally speaking, VIX readings do not remain higher than normal for long periods of time for statistical reasons I’ll go into another time. What you need to know is that high VIX readings can fall quickly.

This is because of something called “mean reversion” which basically signals a return to the mean every time the VIX moves sharply in either direction. Keep in mind, though, that you’ll want to be selective because the VIX can spike at times to do not match up to a steep selloff or a possible low and those are signals you don’t want to take. It can also drop even though angst remains high like it is presently.

Generally speaking, abnormally high VIX readings can be used to judge the potential for a major market reversal… which, I submit based on what I’ve just laid out may be closer at hand than many panic-hazed folks think.

[CRITICAL] Transform Your Life with Only 1 Hour A Day, 4 Days a Week

Trade Idea #1: ATM Options Calls

Aggressive traders could tap into that by purchasing “At the Money” S&P calls, ATM SPX call options, because Gamma – an option Greek measuring price sensitivity – is highest. Conventional thinking is to buy “out of the money” – OTM – call options, but I’m not a fan generally because this trade is intended to capture as much of the move as possible as fast as possible.

Keep risk low by using a smaller than normal position size before you make your move though. This trade will lose money quickly if the markets keep going south. I suggest a time-based stop, rather than the usual dollar or percentage versions we talk about most of the time.

You’re not out of luck if you don’t like options or simply aren’t familiar with ’em.

Aggressive investors could consider nibbling into the SPY, an exchange traded fund that tracks the S&P 500, while using dollar cost averaging to control your entry and your risk. There’s also a leveraged ETF like the Direxion SHS ET/Daily S&P 500 Bull (NYSEARCA:SPUU) which moves 2X to any corresponding move in the S&P 500 if that’s more your “speed.”

This, too, is a one trick pony, so the same risks apply. Only use money you can afford to lose if the markets have other ideas.

Trade Idea #2: Buy Leaps

A lot of people talk about being contrarians but very few really live up to my definition.

And, that is?

Those few folks who buy even when every bone in their body tells them not to or, in the case of a few excellent traders I know, they’re literally throwing up.

This past week certainly qualifies – both of the individuals I’m thinking of puked, then started buying Apple, Alibaba, and other major tech stocks using LEAPs call options.

LEAPs stand for “Long Term Equity Anticipation Securities” – basically long-term options with expirations typically longer than one year away. Doing so, as opposed to buying the stocks that interest them directly, costs less money and can deliver super attractive profits if there’s a turn around.

Right now, for example, Apple Inc. (NasdaqGS:AAPL) has been beaten down to $268.25 as I type. Buying 100 shares will set you back a cool $26,825. However, a AAPL June 17, 2022 $260 Call (AAPL220617C00260000) will cost you only $5,600 or $21,225 less.

Let’s assume that Apple rises to $400 by June 2022 like I think it could. A stock buyer would be smiling no doubt, basking in the glow of a 49.11% return. But the LEAPs buyer would be looking at a much more appealing 64.68% for every LEAPs call purchased.

There are some caveats, though.

LEAPs buyers have to contend with something called time decay, meaning that the value of the price of the option they’ve purchased declines as the option moves towards expiration. At the same time, they’ll have forgo dividends that would otherwise be in their pocket if they purchased the stock outright.

Not bad, eh?

[ACT FAST] This Founder has ALREADY Returned $146 Million to Shareholders

Trade Idea #3: But “Redemption” Stocks

Buy “redemption” stocks poised for a turnaround story when market conditions improve.

Take Boeing Co. (NYSE:BA), for example. Using the VIX as a cue that the broader markets could be nearing a turnaround, it’s one of the most loved/hated stocks available to the investing public at the moment.

The MAX situation has been poorly handled from the get-go and the stock probably has a quarter (or three) to go before things get better, so you can count on indiscriminate selling to scare the pants of normally staid investors. All of which puts the company “on sale.”

Boing has LEAPs options just like Apple does so that’s one way to go after the trade but you can also sell “covered puts” against the stock to obtain an even deeper discount to where shares are trading today, assuming you actually to want to buy it.

For instance, the BA January 21. 2022 $250 Puts (BA220121P00250000) are selling for around $35.20 per contract which means that every put you sell translates into a cool $3,520 in your pocket immediately. The stock has a roughly 50/50 probability of dropping that low according to the options pricing model I use.

Normally, I try to sell puts with about an 75% probability of being out of the money at expiration but the fact that the VIX is so high suggests a similar thinking trader could get closer to the proverbial fire without being burned, or at least singed.

This is an important distinction because this trade is really based on where Boeing won’t be – below $250 on January 21, 2022 – rather than will the stock will be at some point in the future as is the case with Trade Idea #1 and #2.

This trade requires margin, meaning you’re on the hook for the money needed to buy 100 shares for every put option you sell. That requirement varies by broker, so simply make sure you have enough cash available to buy if you need to for any reason. And, honestly, I don’t use a strategy like this one unless I actually do want to buy a stock that interests me.

Anyway, in closing, there may be more selling ahead, but I don’t think it’s too early to start thinking about buying off a bottom if the VIX is accurately communicating that possibility.

Until that’s clear, keep risks small and only put speculative capital to work on trades like these. The risks are still there but so is the potential for some extremely juicy profits.

Virus or no virus.

Until next time,

Keith

The post Three Ways to Profit from A Major Market Bottom appeared first on Total Wealth.

Powered by WPeMatico