Millions of investors are beginning to panic.

The Dow dropped a gut-wrenching 1,031 points Monday from Friday’s close and another points Monday and another 956.29 points Tuesday, following comments from the CDC that the spread of the coronavirus in this country is “inevitable.”

Even CNBC’s Jim Cramer threw in the towel, warning Monday that some stocks are “too toxic to touch.”

I agree.

But you know what?

There IS a list of stocks worth buying.

What’s more, it’s growing by the minute.

Here’s how to find great buys NOW.

What you do right now could set the pace for big profits for years to come.

That’s right, years to come.

Having the right perspective counts for a lot, especially when the you-know-what hits the fan like it is now.

The best part?

Most investors will not see what we’re going to talk about today because they’re frozen like deer in the proverbial headlights.

Admittedly, it’s hard not to be, frozen that is.

There will be more bad news about the coronavirus ahead. The Presidential elections are going to make a disorderly kindergarten class look tame compared to headlines that even Hollywood couldn’t come up with. The IMF, WHO, and CDC along with every other alphabet-soup agency out there will warn about global growth.

All of those things are true – but so freakin’ what?

Repeat after me… global growth may slow, but it will not stop.

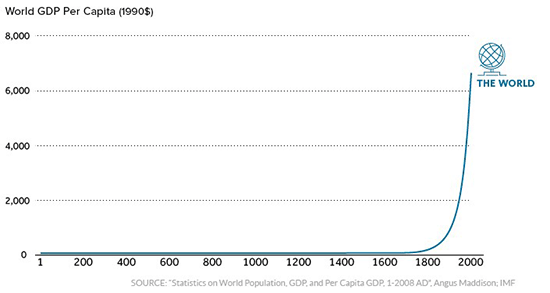

Say it twice if you have to, or tape the following chart to your mirror if you must.

[CRITICAL] Investing in This Could Have Landed You A Spot on Forbes’s List of 100 Richest Americans

Capital is a constantly expanding resource and you can see that in this chart highlighting the last 2,000 years of economic history.

Then, ask yourself this: do you really think that everything is going to grind to a halt…? That there aren’t companies out there with plenty of profit potential??!!

Then, ask yourself this: do you really think that everything is going to grind to a halt…? That there aren’t companies out there with plenty of profit potential??!!

To be clear, I’m not suggesting you throw caution to the wind and pile in. That’s a sucker’s game, given the headlines; “buying the dip” is exactly what Wall Street wants you to do because it helps them separate you from your money.

What I am urging is a measured, risk-based approach that’s proven to line up gobs of profit potential using a small fraction of your portfolio to nibble in. Even a few hundred bucks or just 1% of your cash on hand could mean the difference between getting taken to the cleaners and fighting back profitably.

Here’s a screen you can use to get started:

- Market capitalization greater than $1 billion

- Altman Z-Score greater than 2

- Yield above average S&P 500 stock

- Payout Ratio less than 60%

- Dividend Growth greater than 5% over the past 5 years

- At least two consecutive years of dividend increases

The goal is to identify a list of quality companies with enough liquidity, quality, and growth needed to be worth the risk of ownership when the SHTF – an acronym meaning something I cannot print here.

Feel free to tweak the criteria to match your personal objectives and risk tolerance; this is merely a starting point intended to help you identify great companies that have been put on sale.

That’s something a lot of investors are missing right now.

The temptation is to think the sky is falling but that’s not really the situation as long as the business case for owning companies like the ones that will come up in this screen remains intact.

[LAST CHANCE] S.C.A.N Technology is the Simplest Way You Can Make Big Windfalls in Weeks

Take Lockheed Martin Corp. (NYSE:LMT), for example.

The stock has been beaten down mercilessly from a high of $442.53 on February 11th to $405.28, where it’s trading as I type. On the surface that looks terrible, but the business case – to my point – remains rock solid:

- Fundamentally strong defense contractor with a $115 billion market cap

- Yield 2.2%

- Payout ratio is a low 41%, meaning there’s plenty of extra capacity

- 5-year dividend growth rate is 10.3%

- 18 years of dividend increase

The company has top line growth from $47.25 billion in 2016 to $59.8 billion in 2019, and that’s not something that will simply vanish… virus or no virus, no matter who’s in the White House, no matter what the Fed does next.

Drug companies… similar story.

Big tech… same thing with the added twist that many will substantially increase profits if people are homebound.

In closing, I know it’s tempting to run for the hills. I get that.

My wife and I are right there with you. You are not alone by any stretch of the imagination.

I’ve been actively involved in the financial markets for 37 years and a keen student of history for even longer. And, if there’s one thing that I have learned in all that time it is that it always pays to play offense.

Always!

Adjust your tactics if you have to, refine your purchases, or simply be more choosy.

Be “in to win” or you won’t… win.

We have more computing power than any other time in history working on the coronavirus situation and anybody who doubts that we will fix this is sadly mistaken.

Don’t be “that” person standing there hands out wondering if you shoulda’ bought when you had the chance afterwards!

I will be with you every step of the way.

Until next time,

Keith

The post My “Buy List” is as Long as a CVS Receipt, But… appeared first on Total Wealth.

Powered by WPeMatico