The markets are giving many investors fits, and I’m getting more than a few questions on retirement plans at the moment.

Specifically, 401(k)s.

I’m hearing from a lot of folks who are scared to death they’re going to lose everything, while others are simply fearful about what’s next.

Either way, a little perspective can help.

Crashes – regardless of cause – tend to raise lots of questions at the most inopportune time.

That’s totally understandable.

Far too many people find out the hard way that they’ve been speculating, not investing. And, react accordingly if not also predictably.

Social scientists chalk this up to something called “time-urgency,” and it’s a classic Type-A behavior, according to Dr. Michael Ashworth.

There’s a twist when it comes to your money, though.

People in this position simply don’t understand the difference between urgency and importance. That’s why the sensation “I gotta do this now” is so very powerful.

Perspective really does matter at times like the present because that’s what gives you the strength needed to marry short-term actions with long-term results and consistent profits, practically no matter what the markets do next.

Speaking of which, let’s dive in with a few of the most pressing 401(k)-related questions I’ve received.

[BREAKING] The Biggest Market We’ve Ever Uncovered Could Help You Make Big Bucks

Q: Should I sell everything and run for the hills?

A: That depends entirely on the timeframe you’re dealing with.

If you’re a millennial, for example, you may have 20 or more years before you need the money, in which case selling out would potentially be the worst and most expensive mistake of all. Everything just got put “on sale” at once-in-a-lifetime prices.

If you’re a boomer and on the cusp of retiring or have recently retired, the situation changes because your primary risk is outliving your money. So, not surprisingly, you have to balance risk and reward more carefully.

Most conventional financial models fail miserably in this regard because they’re based on outdated life expectancy. Most people are simply living longer so more (intelligent) risk is in order rather than less as is commonly believed.

If you need your money within the next few years and you’re losing sleep, then selling becomes a very real need, not just an option. The question is how to do that intelligently and what is enough.

Ask your financial advisor specifically what’s right for your situation to be sure!

Q : Should I scale back contributions to my 401(k) if there’s more selling ahead?

A: I’d actually argue for the reverse in many cases. The markets, as we have discussed many times, always reward discipline. That’s why now could be an ideal time to max out contributions that can help you take advantage of the market’s decline. Obviously, that has to be fine-tuned depending on where you are in the age spectrum we just discussed, but that’s a minor concern.

What you want to focus on intently is how you turn the Coronavirus situation into an opportunity that matches your unique circumstances.

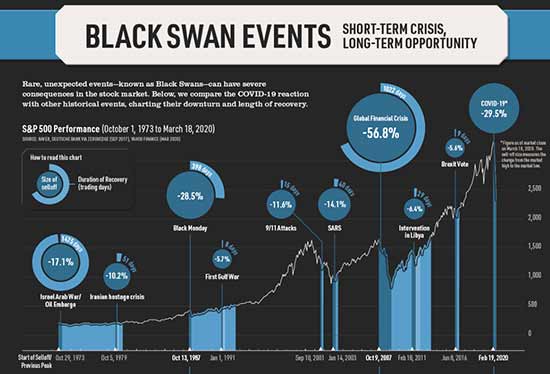

Figure 1 VisualCapitalist.com

Figure 1 VisualCapitalist.com

Dollar Cost Averaging, a Total Wealth Tactic I’ve written about many times, can help you do that by making sure you “buy low and sell high” every time, not just once in a blue moon.

That said, you’re not alone if you’re anxious about what’s happening. But don’t confuse that with the knee-jerk reaction to sell everything.

Your body is simply telling you that your portfolio doesn’t match up to your risk tolerance and expectations. That’s an easy fix using another Total Wealth Tactic we’ve talked about frequently: Rebalancing.

Q: What do I do if I’m about to be laid off?

A: Rather than focusing on putting more money into your 401(k), consider using that contribution to boost your emergency fund. Commonly held wisdom is 3 to 6 months of expenses, but I’ve always advocated at least a year’s worth.

Take on or start a side hustle that could help bring in extra cash. WalMart, Amazon, CVS and other critical retailers are hiring as fast as they can to help everyone through the crisis. So there may be something that’s a quick uptake.

Don’t cut everything loose if you can help it, though.

Many employers offer a “match” meaning they’re going to help you put money into your 401(k) based on a predetermined contribution level. Find out what that is and consider making the minimum to keep the “match” going.

Above all else, try as best you can to keep your investment portfolio focused on the future, even though your needs may be more about the present.

Missing opportunity is always more expensive than trying to avoid losses.

[TRANSFORMATIVE] How One Easy Strategy Can Flip Your Financial Situation

Q: What if I’ve already lost my job or been laid off?

You’re not alone, and you’re not out of options.

Obviously, you’ll want to take a good hard look at your budget and cut accordingly to make ends meet. Build up the emergency fund, get another job wherever you can doing whatever you can; the time to be choosy will come, but keeping cash flush is critical.

Most employers can help you roll your 401(k) into an individual retirement account, a smart move that helps you avoid suddenly having to pay taxes you didn’t count on. Generally speaking, you can opt for a “direct rollover” which means your former employer writes a check to your new employer or IRA account. Then, reinvest using the Unstoppable Trends, “must-haves,” and careful risk management based on how much cash you’ll need and when.

If that’s not the case and your employer doesn’t offer a direct rollover, Uncle Sam gives your 60 days to reinvest a check that’s cut directly to you for the balance of funds in your 401(k) without having to pay taxes. Again, reinvest as fast and prudently as you can, given your immediate cash needs. What you’re trying to avoid is getting left at the station if the rally gains legs like I think it might.

The recently passed CARES Act – Coronavirus Aid, Relief, and Economic Security Act – stipulates that any American facing financial hardship because of the coronavirus can take an early withdrawal of up to $100,000 with having to pay the usual 10% penalty for doing so.

There’s a catch and, unfortunately, it’s entirely predictable. Uncle Sam wants you to pay income tax on that money which is really a double whammy to my way of thinking.

I’ve just scratched the surface today so, again, please do check with your financial advisor to be sure about the options you have or don’t have given your personal financial situation, risk tolerance and investment objectives.

Everybody is unique which means there are plenty of solutions.

Let me leave you with a final thought on that note.

There are plenty of reasons not to invest but none of ’em compare to the single most important reason TO invest.

Growth may slow, but it will not stop at the end of the day.

Until next time,

Keith

The post What to Do with Your 401(k) Right Now appeared first on Total Wealth.

Powered by WPeMatico